For the last two decades, synthetic biology (synbio) has been hyped as the ultimate game-changer. The pitch was intoxicating: biology is just another programming language, and soon we’d be hacking DNA like software to grow fuels, medicines, and materials on demand. We were promised algae-powered cars, lab-grown steaks, and bacteria brewing designer drugs, all with a side of sustainability.

Investors threw billions at the dream of a trillion dollar bioeconomy. Governments jumped on board. Headlines declared that biology was about to eat the world.

The expectation? That synbio would do for organic matter what computing did for information.

The reality? Biology doesn’t follow Moore’s Law, and the “build fast, break things” ethos of tech doesn’t translate well when your product is, well, alive.

In the words of Drew Endy, “A cell is not a computer —a cell is a cell”. If you take nothing from this piece, at least know this.

Fast forward to today: the hype train has slowed (choo choo), and some synbio darlings have crashed spectacularly (RIP Zymergen). So, what happened? Why haven’t synbio’s promises materialized at scale? And crucially, does that mean it was all just biotech vaporware?

Short answer: No. But the long answer is much more interesting I promise.

This piece will take you on a tour of synbio’s hits, misses, and why despite the turbulence, I think its far from over. Let’s explore why synbio’s scalability and commercial adoption have lagged behind its grand expectations and ambitions. I will also cover the multiple sectors where synbio was supposed to be the game-change, from biofuels to pharma to materials.

Along the way I’ll also share some market data and the core challenges slowing commercialization. There is a deep misconception around Synbio. Some still project utopian expectations, while others have succumbed to disillusionment.

I believe that synbio has made significant strides, but it remains burdened by premature, inflated promises that set unrealistic expectations. Understanding this dynamic is key to separating genuine progress from wishful thinking, and ensuring the field can mature beyond the dream into something real, something alive.

Let’s get into it!

What Happened to Utopia?

In the mid 2000s, as DNA sequencing became relatively fast and cheap and gene editing tools improved, synbio emerged with a near utopian level of optimism. There was a lot of talk on biology as “the next industrial revolution”, turning cells into microscopic factories to produce fuels, chemicals, medicines, and materials with no cost to the planet.

The dream: DNA is code, cells are computers, and biology is just another engineering problem. Early synbio pioneers and startups made audacious claims with short timelines that were great for clickbait media. *Cue John Williams ‘Welcome to Jurrasic Park’ theme music

The reality? Cells are messy, unpredictable, and prone to mutiny. Unlike silicon chips, living organisms evolve, adapt, and occasionally decide that your carefully designed metabolic pathway is a terrible idea that they no longer care for.

At the peak of synbio euphoria, it wasn’t just a biotech thing, it was really the thing. Governments, investors, and startups envisioned a world where biology would upend trillion-dollar industries overnight. Every industry wanted a piece of the synbio revolution pie:

Energy (Biofuels):

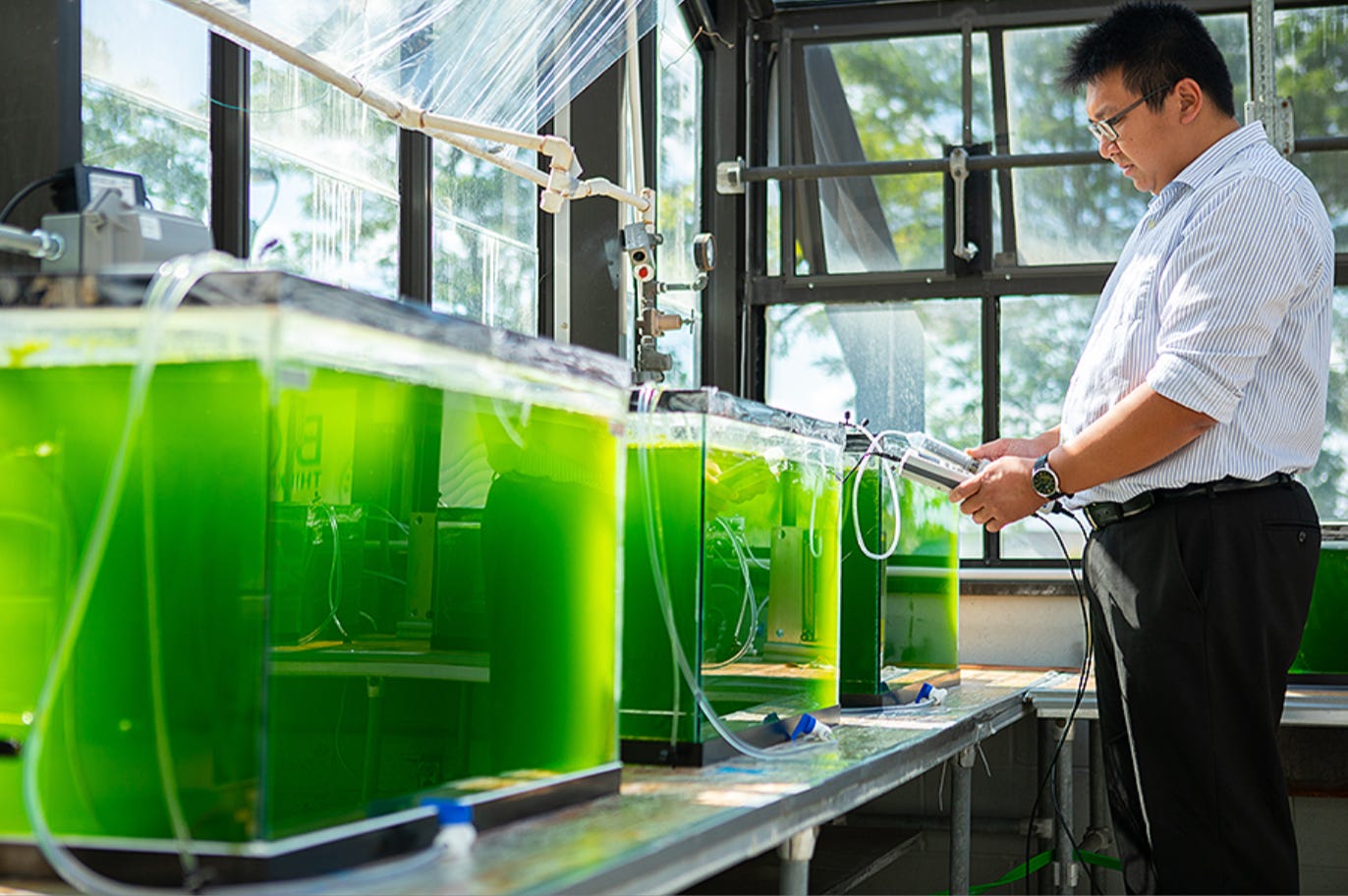

Biofuels were supposed to be synbio’s first blockbuster win. Companies like Amyris, Solazyme, and LS9 spent years engineering yeast, algae, and bacteria to produce hydrocarbons, essentially brewing gasoline, diesel, and jet fuel from sugar or sunlight. In the late 2000s, the dream of “grassoline” fuel from grass or waste instead of petroleum led to wildly optimistic mandates. U.S. Congress, in a 2007 energy law, set a target of 16 billion gallons of cellulosic biofuel by 2022.

Fermentation-based fuel production proved wildly expensive, unpredictable at scale, and way too slow to compete with dirt-cheap petroleum. One by one, synbio biofuel startups pivoted, Amyris went into skincare, Solazyme rebranded as a food ingredients company, and LS9 was quietly absorbed. The “grassoline” revolution? More of a niche luxury item than an ExxonMobil killer.

Pharmaceuticals & Health:

If synbio has a gold star, it’s in medicine. Engineered microbes already manufacture insulin, cancer drugs, and vaccines at industrial scale. Companies like Ginkgo Bioworks positioned themselves as organism design factories, promising to churn out new therapeutic molecules on demand. And while some of these bets have been slower to pay off, the field has delivered in some important arenas, CAR-T cell therapies, synthetic hormones, and precision fermentation for critical medicines.

Materials & Chemicals:

What if we could brew high-performance materials; spider silk stronger than Kevlar, self-repairing fabrics, or biodegradable plastics?

That was the idea, and companies like Bolt Threads, Zymergen, and Spiber dreamed big.

The reality? Spider silk never quite scaled, Zymergen crashed and burned, and most bio-based materials have blended fractionally into existing supply chains rather than taking them over. That said, some real wins have emerged: Genomatica’s bio-nylon is making its way into apparel, and brands like Lululemon and Adidas are rolling out bio-based alternatives in small batches. I wouldn’t say the dream is dead, it’s just on a different timeline than might have been previously suggested.

Agriculture & Food:

Agriculture was always a natural fit for synthetic biology, but the industry still remembers the GMO backlash of the early 2000s (thanks Monsanto). That’s why synbio players in this space have been careful with their branding.

Rather than engineering crops directly, companies like Pivot Bio have focused on things like soil microbes that replace synthetic fertilizers, offering farmers a lower-risk, regulation-friendly entry point to biotech. Meanwhile, the cultured meat industry, led by companies like Upside Foods and Finless Foods, is proving that animal-free protein is possible, though price parity with traditional meat is still years away.

The agricultural vision was farming with engineered biology at every level: seeds, soil, and supply chain, to increase yields sustainably and even grow food in novel ways. This holy grail of fully programmable farms, where synbio even helps crops grow in extreme environments is a work in progress.

Environmental Biotech (Bioremediation):

One of synbio’s most utopian promises was engineering life to clean up the mess we’ve made, bacteria that eat oil spills, microbes that capture CO₂ from the air, and algae that absorb industrial waste. The problem? Regulation, tech and economics.

While engineered microbes can digest pollutants, deploying them outside the lab is tricky. Environmental laws don’t love the idea of releasing genetically modified organisms into the wild, and scaling these solutions is slow. That hasn’t stopped researchers from exploring ways to use synbio for carbon capture or plastic degradation, but we’re still in the early days.

It’s hard to overstate the excitement during synbio’s rise and even in recent times. The growing ecosystem included competitions (iGEM, where students globally built synbio project), incubators, and the synbio dedicated conference SynBioBeta was founded in 2012 to bring the community together.

Influential voices from Craig Venter boasting of synthetic cells to investors like Vinod Khosla backing synbio biofuel startups helped create this sense that a biological revolution was imminent. It was palpable. An Arthur D. Little report noted that SynBio’s potential applications span so many industries that it’s “unique in breadth” and could disrupt sectors comprising 15-20% of the global economy.

One analysis by McKinsey later projected synbio’s direct economic impact could reach $3.6 trillion per year by 2030-2040 if its 400+ use cases come to fruition. These numbers, splashed in glossy infographics, further fed the frenzy.

There was a pervasive, and honestly still existing philosophical stance that life’s complexity could be tamed by human design. Synbio evangelists often spoke of a future of biological mastery over nature and the genetic code underpinning all living things. It was clear the goal was dominance, not collaboration.

Cells were seen as hardware, DNA as code. This mechanistic view of life dating back to Descartes, was taken to an unprecedented level. There’s an almost Promethean like ambition here: humanity harnessing the fundamental processes of life for our purposes. It’s no wonder it inspired both awe and anxiety (Mary Shelley’s Frankenstein comes to mind here).

By the end of the 2010s, the promises had piled up. The stage was set for either spectacular delivery or a reality check. It’s turned out to be a bit of both. Synbio did have some important wins, but many of its highest-profile objectives remained out of reach (for now).

Understanding what happened requires looking deeper at how these visions collided with the cold, hard walls of scale-up and economics.

The Hard Reality of Scaling Biology

Let’s dive deeper into synbio’s industrial scale up reckoning. The lesson: big ideas and big money can get a technology off the ground, but at some point, nature and economics have the final say on when things can actually come to fruition.

Several core challenges have consistently undermined synbio scale-up efforts across industries:

Lesson 1. Cells Are Not Circuit Boards:

The field has learned (the hard way) that you can’t simply debug living cells as easily as software, nor scale reactors like you scale server farms. A microbe that produces a valuable molecule at high efficiency in a test tube suddenly tanks in a 10,000-liter bioreactor. Enzymes misfire. Cellular stress responses kick in. Mutations accumulate. It can be total anarchy. The result? What looked perfect on paper crumbles in practice. Engineering biology isn’t impossible, it just requires a level of complexity and iteration that early hype ignored or conveniently did not mention.

The complexity of metabolic pathways means unforeseen bottlenecks or toxic byproducts can emerge when scaling up production of a target molecule. This fundamentally limits reliability and requires extensive trial-and-error to troubleshoot, which is time-consuming and super costly.

Lesson 2. Do Not Go for High Volume - Low Cost Ever (or at least on short timelines):

Many synbio startups have found themselves stuck in what we might call scale-up purgatory, years of investor money spent incrementally improving yields, tweaking bioprocess conditions, and struggling to reach commercial volumes at viable costs.

For biofuels and chemicals, the economics are brutal. A microbe that produces 50 g/L of a fuel precursor sounds impressive on paper, but when you factor in purification, processing, and logistics, the numbers rarely add up. Competing with $2 per-gallon fossil fuels is brutal. Even a small increase in yield, from 50 g/L to 100 g/L, can take years of optimization, if it’s even possible at all.

The reality is the cost competitiveness of many synbio products just isn’t there yet and maybe that would have be okay if people were aware of realistic timelines.

Amyris learned this the hard way. Their engineered yeast could make farnesene (a potential diesel substitute), but getting it to market at a competitive price? Not happening. They pivoted to high-margin products like fragrances and skincare instead. The takeaway: If you want to make money in synthetic biology, avoid bulk commodities. Go for specialty chemicals, pharma, or high-value materials where customers are willing to pay a premium

Lesson 3. The Great Infrastructure Problem:

Unlike software, which scales with a few more servers, synbio requires massive physical infrastructure. Fermentation tanks, purification facilities, industrial bioreactors, these things aren’t cheap. This is not just a science challenge but an enormous capital project.

Building a bio-based manufacturing facility can cost hundreds of millions, and most startups simply don’t have that kind of cash. Many assumed they could just outsource to contract manufacturers, but even that requires a bulletproof, well-optimized process. If your engineered microbes don’t behave exactly the same in someone else’s facility, you’re back to square one.

The high capital expenditure and risk of failure made investors skittish about funding full-scale plants. One by one, many biofuel startups shelved plant construction or kept it minimal. A World Economic Forum report called it out in writing “high initial costs, lengthy development timelines, and lack of established pathways to achieve commercial-scale production” as bigger barriers than the science itself.

Lesson 4. Regulatory and Public Perception is Paramount:

Synbio doesn’t just have to work, it has to win over the world. A world that has been burned by bad actors and with only few actors actually working at scale in synbio…the entire industry looks bad and for good cause.

As a result, releasing genetically engineered microbes into the environment? That raises regulatory red flags.

Using synbio to tweak food production? Cue the anti-GMO crowd.

Even seemingly harmless applications like using engineered yeast to make vanilla have triggered debates over what counts as “natural.” (Spoiler: Some advocacy groups still oppose it, even though it’s chemically identical to plant-derived vanilla.)

Lesson 5. We Don’t Know What we Don’t Know Until we Know it…

Finally, synbio has been humbled by the sheer complexity of biological systems. What about the early dream of completely standardized, plug-and-play genetic circuits? Turns out, biology doesn’t easily standardize. A synthetic gene circuit that works perfectly in E. coli might fail in yeast. A metabolic pathway that behaves one way in the lab might go rogue in an industrial setting. Bioengineering isn’t just about making things, it’s about constantly troubleshooting things that were previously working and now don’t.

Flagship Industry Reckoning

No one learned these lessons more than the flagship golden childs’ that road the waves of synbio hype all the way to either death, a clever pivot or bankruptcy.

Several flagship synbio companies that once sported multibillion-dollar valuations fell out of orbit and back to Earth in quite a big way:

Zymergen was supposed to be synbio’s poster child for the future of materials using AI and robotics to engineer microbes for making novel polymers. It IPO’d in April 2021 at a $3 billion valuation.

Just months later? The company admitted its first product wouldn’t be commercially viable anytime soon. Investors panicked, and the stock plummeted 68% in a single day.

By 2022, Zymergen was dead in the water. The company laid off staff and was eventually scooped up by Ginkgo Bioworks for next to nothing comparatively. It was a sobering moment: a stark reminder that biology doesn’t move at software speed, and “AI-driven bioengineering” doesn’t mean much if the products don’t work at scale.

Ginkgo Bioworks positioned itself as the platform for synthetic biology, a foundry that would design microbes for everything from pharmaceuticals to industrial chemicals. In 2021, it went public via SPAC at a staggering $15 billion valuation.

For a while, it seemed like synbio had its first true giant, but once again reality came knocking. The actual royalties and downstream revenue from its foundry model were much slower to materialize than imagined. By 2023, as investors soured on the large synbio speculative biotech bubble, Ginkgo’s stock had lost most of its value. That same year, it laid off a third of its workforce.

However, Ginkgo is still standing, with plenty of partnerships, a shiny new automation platform and ongoing projects. The company now finds itself having to recalibrate expectations.

It is now a case study in the misalignment of expectations that can arise from speculative biotech. Ginkgo has since tempered some messaging, emphasizing the long-term horizon and downplaying short-term hype and pivoting more towards the stable and growing space of pharma consumer biotech.

Amyris the granddaddy of synbio startups (founded 2003), which pivoted from biofuels to personal care products, finally ran out of runway. Despite successfully commercializing some products (like a sugar-derived skincare ingredient squalane), the company burned cash at a relentless rate. In 2023, Amyris declared bankruptcy, unable to service its debt.

Over its 20-year life, Amyris exemplified the constant pivoting many synbio firms underwent: fuel to chemicals to consumer goosds, chasing a profitable business model. Co-founder Jay Keasling (a synbio pioneer) noted “there has been a reckoning” as Amyris and others fell.

These high-profile cases sent a clear message through the industry: it’s time to recalibrate. Delivering on synbio’s promise is harder and takes longer than many anticipated. The hype was meeting reality.

Not all news was bad. Companies focusing on pragmatic, lower-risk applications, like enzymes, pharmaceuticals, and food ingredients, were faring better. Unlike biofuels or futuristic materials, these products didn’t require billion-dollar infrastructure or moonshot technological breakthroughs to be profitable. But overall, by 2023 there is a sense that synbio needs to sober up.

Perhaps the clearest quantitative indicator of this reckoning is the investment cycle. After peaking in 2021, synbio funding saw a steep decline. Total synbio funding in 2022 was about $10.3B, down 53% from the prior year.

Don’t Throw the Proverbial Synbio Baby Out with the Bathwater

Sure, synthetic biology has had its fair share of reality checks, but let’s not pretend it’s been all smoke and mirrors. The field today is miles ahead of where it was 15 years ago, just not in the loud, explosive way the narrative used to suggest. Progress has been more of a slow burn than a Big Bang, but that doesn’t mean it isn’t real. Here’s where synbio has quietly been winning:

Cheaper, Faster DNA Manipulation:

The cost of DNA sequencing and synthesis, reading and writing DNA has plummeted. The ability to print thousands of genes (even whole genomes) relatively affordably is a game-changer. This has enabled massive experimentation. For example, companies like Twist Bioscience now supply genes at scale for research and industry, something that in 2005 was painstaking and expensive.

CRISPR and the Biohacker’s Dream:

CRISPR-Cas9 changed the game in 2012, making gene editing as precise as a scalpel instead of a sledgehammer. It’s not a uniquely synbio invention per se, but it has supercharged the field by letting researchers edit genomes with stunning efficiency. The design-build-test cycle for synthetic biology suddenly got way tighter. Want to make a bacteria that produces jet fuel? A yeast that churns out drugs? Now you can iterate quickly instead of waiting months (or years) to see if your microbe is cooperating.

Success Stories in Pharma:

Synthetic biology is already making medicine better, even if it doesn’t always get the credit. Case in point: the malaria drug artemisinin, historically derived from rare plants, is now brewed by engineered yeast, ensuring a stable global supply. mRNA vaccines? They didn’t come from nowhere; decades of bioengineering advancements made that lightning-fast COVID vaccine rollout possible. Then there’s CAR-T therapy, where immune cells are genetically reprogrammed to hunt cancer, textbook synbio at work.

Industrial Enzymes & Everyday Synbio:

Not everything has to be futuristic to be valuable. Companies like Novozymes have built billion-dollar businesses by engineering microbes to produce industrial enzymes making laundry detergents work better, food processing more efficient, and biofuels slightly less of a headache. Then there’s the stuff we don’t even think about: synthetic vanilla made by yeast (instead of scarce vanilla beans), engineered stevia that actually tastes good, and Impossible Foods’ GMO yeast-derived heme that makes plant burgers taste meaty. You may not notice, but synbio is sneaking into supply chains all around us.

Materials Partnerships:

Okay, synbio materials admittedly have had a rough start. spider silk jackets haven’t exactly taken over the world, but the field is finding its groove. Companies like Genomatica are working with major brands to replace petroleum-based nylon with bio-based alternatives, while others are making polyurethane foams and spandex with engineered microbes. The key? These materials aren’t marketed to replace main material sources in the next 5 years, they’re just better materials that happen to come from biology and will take time to reach their full potential.

New Frontiers of Cell-Free Systems and AI Integration:

The next frontier is a wild mix of AI, automation, and cell-free synthesis. Instead of tweaking entire cells, researchers are isolating key metabolic pathways and running them in test tubes, think of it as biomanufacturing without the biological baggage. Meanwhile, AI-driven protein design (shoutout to DeepMind’s AlphaFold) is helping scientists build enzymes and genetic circuits that actually work as intended. If synbio’s early problem was biology not following the blueprint, AI might just be the missing piece.

The big, splashy synbio revolution didn’t exactly happen overnight like many hoped, but that doesn’t mean it isn’t happening. Instead of headline-grabbing moonshots, progress has come in subtler ways, better medicines, more efficient industrial processes, and a slow creep of engineered biology into everyday products.

The inflated expectations of the 2010s might have been unrealistic on timing, but many were directionally right, biology is becoming more engineerable year by year.

Navigating the Future: From Disillusionment to Enlightenment

So where does synthetic biology go from here? If we take a step back: the field stands at a juncture between humility and hope. The initial hubris has been tempered, but the core hope that we can harness living systems for good remains very much alive.

There’s a famous concept in technology called the “Gartner Hype Cycle,” which describes how new technologies tend to be overestimated in the short term and underestimated in the long term.

It typically goes: an initial Technology Trigger leads to a Peak of Inflated Expectations, followed by a crash into the Trough of Disillusionment, and then (for those that survive) a gradual climb up the Slope of Enlightenment toward a Plateau of Productivity. This model has played out time and again, in artificial intelligence, in nanotechnology, in renewable energy, etc. Synthetic biology appears to be no exception.

Philosophically, there’s also an intriguing undercurrent. Synbio’s story forces us to reconsider our relationship with nature. Initially the narrative was one of domination, we will rewrite life’s code. Now, a more nuanced perspective must emerge. One that works with biology’s inherent capabilities rather than against them. A sort of reconciliation with biology itself.

Great insights!

Thank you for this! 🙇🏼